ESTATE PLANNING NEWS & ARTICLES

Giving Back: Donating to Charity Via Your Estate Plan

For many, leaving a legacy is very important. Giving to a charitable organization is a popular way to do just that. Done properly, the organization will benefit from the donation and its own tax exempt status and the giver benefits from “doing good” and various tax benefits. It’s a serious win-win.

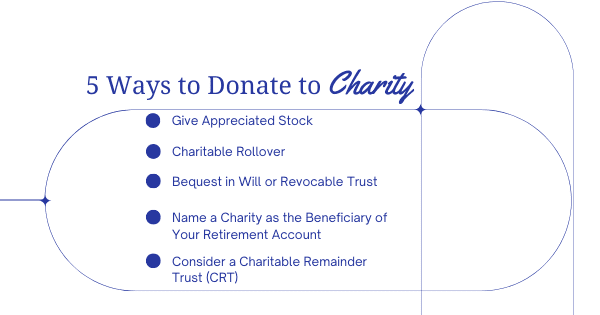

Tracy Craig, Fellow, ACTEC, AEP® addresses these five ways to donate to charitable institutions in her article on Kiplingers.com : Give Appreciated Stock, Charitable Rollover, Bequest in Will or Revocable Trust, Name a Charity as the Beneficiary of Your Retirement Account, Consider a Charitable Remainder Trust (CRT). (NOTE: If you are interested in any of these solutions, please consult a tax and estate planning professional in your area to be sure that you are eligible.)

Ways to Donate to Charity Via Your Estate Plan

Stock

If you have appreciated stock that you are thinking of selling, instead of selling it and paying capital gains taxes, donate that stock “in-kind” to your favorite charity and receive a tax deduction equal to the fair market value at the time of donation.

Qualified Charitable Distribution (QCD)

If you are 72 years or over and don’t need to cover your living expenses with a distribution from your IRA, you may consider donating directly to a charity of your choice. “With a QCD you can benefit charity, fulfill your required minimum distribution (RMD) requirement, and exclude that amount from your income for enhanced benefit,” summarizes Craig.

Will or Revocable Trust

Leaving a bequest using the charity’s legal name (since many are similar) in your will or trust is another solid and simple way to donate to a charity. You can request that it be used in a specific way by the organization, but talking with them ahead of time to be sure that they can carry through with your request is a good idea. If you are a multimillionaire here in Arizona, then your generous donation may reduce your federal estate taxes too, but for most of us this will not be of benefit at least as the tax code is written now. (Check with your tax professional.)

Retirement Account

Another option for someone donating to charity through their estate plan is to make the charity a beneficiary of your non-Roth retirement accounts. Remember that a beneficiary designation form will be used and it will override any designations you make in a will or trust. This also lessens the tax burden on any individuals who inherit since non profits are exempt.

Charitable Remainder Trust (CRT)

As we’ve mentioned before, trusts are important tools in your estate planning arsenal. “You can benefit a charity and a family member by creating a charitable remainder trust (CRT) and naming the CRT as the beneficiary of your IRA. A CRT is a split interest trust where an individual you choose will receive annual payments from the CRT for a period of time. When the individual’s interest in the CRT terminates, the remaining amount is distributed to charities of your choosing,” explains Craig, who notes that the main reason to consider using a CRT is that the CRT itself is tax-exempt (like a charity).

Why Sharing Your Donation Plan is Important

Once you have chosen your charity and the method of donation, I recommend reaching out directly to the organization. The reasons are simple:

- Like all businesses charities must plan for the future. Knowing they can expect a gift down the road is helpful.

- It gives you an opportunity, if the gift is sizable enough, to perhaps shape a part of the institution’s program or at least direct the money toward part of the program that means the most to you. We highly encourage you to discuss a directed gift with the organization to be sure it is possible and addressed properly in your estate plan.

- It lets the organization know they are doing good and may help attract other donors.

Even if you can’t donate money, the gift of your time (and your family’s time — even your kids) is a precious gift to any organization, though lately you will want to check with each organization to see how they are handling COVID safety.

Act Locally: Charities to Consider

All non-profits can use donations of money, goods or time. Here are some suggestions for local charities to work with:

Mission of Mercy Arizona

Provides FREE healthcare care and prescriptions to those with no health insurance or inadequate coverage. Particular focus on chronic conditions that impede quality of life, like diabetes and hypertension and restoring dignity with love and compassion.

How to help: You can volunteer or donate in a number of ways: https://www.amissionofmercy.org/arizona/support-work/

Clinics held in Chandler, Mesa, Avondale and Phoenix; tours available

Main address: 360 E. Coronado Road, Suite 160, Phoenix, AZ 85004

Phone: 602 861-2233

Check for a Lump

Check for a Lump was founded in 2009 with the simple goal of encouraging women to perform monthly breast self-exams. Their mission has since expanded to providing free

breast health education, mammograms, testing and direct assistance to breast cancer patients with wigs, support and resources in Arizona.

How to help: Volunteer, donate, sponser

602.688.5232

Matthew’s Crossing Food Bank

Through food drives and donations, Matthew’s Crossing Food Bank is a charitable organization that has been helping to feed Arizona’s hungry since 2001.

How to help: The food bank typically needs more food and volunteer help in the summer months.

1368 N. Arizona Ave., Chandler.

480-857-2296

St Mary’s Food Bank

Local families are turning to St Mary’s Food Bank in record numbers because they have lost their jobs and donations from companies are not as plentiful because companies have not fully reopened.

How to help: When you make a donation to St. Mary’s Food Bank, you can receive a dollar-for-dollar tax credit on your AZ state return. Receive up to $400 for individuals and $800 for those filing jointly.

Details:

2831 N. 31st Avenue Phoenix, AZ 85009

(602) 242-FOOD (3663)

St. Vincent de Paul

The Society of St. Vincent de Paul is an international non-profit organization dedicated to serving the poor and providing others with the opportunity to serve.

How to help: Feed, cloth, house, heal … the program has a multitude of ways to get involved including adopting a family for Christmas.

Details: SVDP has multiple locations across the Valley so visit this page to contact.

ICAN

ICAN is an East Valley after-school program that relies heavily on volunteers, including youth who are at least 15.

How to help: Teens may assist kids with homework or in the computer lab, with arts and crafts, sports and recreation, and during special events. An application, interview and orientation are required. Volunteer opportunities are available for age 10 or older to volunteer with an adult.

Details: 650 E. Morelos St., Chandler.

480-821-4207

Feed My Starving Children

Christian non-profit Feed My Starving Children (FMSC) has tackled world hunger since 1987 by sending volunteer-packed, nutritious meals to 70 countries.

How to help: Volunteers are needed for 2-hour packing sessions to hand-pack life saving meals for starving childre

Details: 1345 S Alma School Rd, Mesa, AZ 8521

480-626-1970

We’d love to hear from you if you can suggest a charitable program to add to our list. We know there are MANY worthy ones! So pick one and do your part. It’s good stuff – the best gift you can give yourself and your family and others.

NOTE: Updated 8-10-2023